The Complete Guide to EV Betting: How to Maximize Profits with Expected Value

Sports betting has exploded in popularity, with millions of bettors worldwide looking for ways to gain an edge. While most casual bettors rely on intuition, trends, or fandom, sharp bettors understand that long-term success requires more than gut feelings. Enter EV betting—short for expected value betting—a data-driven approach that helps bettors consistently identify wagers with positive profit potential.

In this guide, we’ll break down what EV betting is, how to calculate expected value, why it works, and how you can apply it to your betting strategy. Whether you’re a beginner or an experienced bettor, learning EV betting can completely change the way you approach the game.

What is EV Betting?

EV betting, or expected value betting, is a strategy that evaluates the potential profitability of a wager over the long term. Instead of focusing on short-term wins or losses, EV betting looks at whether a bet will generate profits if made repeatedly under the same conditions.

The concept of expected value (EV) comes from mathematics and probability. In sports betting, it measures the difference between the true probability of an outcome and the implied probability suggested by the sportsbook’s odds.

A positive EV (+EV) bet means you’ll make money long term if you place that wager consistently.

A negative EV (-EV) bet means you’ll lose money in the long run, even if you occasionally win.

Why EV Betting Matters

Most sportsbooks build a “vig” or margin into their odds, ensuring that recreational bettors usually lose over time. This is why most casual bettors chase short-term wins but end up in the red long term.

EV betting flips the script. By consistently identifying +EV opportunities, bettors:

Beat the vig and capture value sportsbooks miss.

Maximize bankroll growth instead of relying on luck.

Turn betting into investing by focusing on probability and mathematics rather than emotion.

Simply put: EV betting is the difference between gambling and making calculated, profitable decisions.

How to Calculate Expected Value in Sports Betting

Step 1: Convert Odds to Implied Probability

Example: +150 odds → implied probability = 40%

Step 2: Estimate the True Probability

Use stats, models, and tools like PickTheOdds, which aggregates data across markets to highlight mispriced lines.

Step 3: Apply the EV Formula

EV = (True Probability × Profit) – (False Probability × Stake)

Example: A +12.5% edge on a $100 bet.

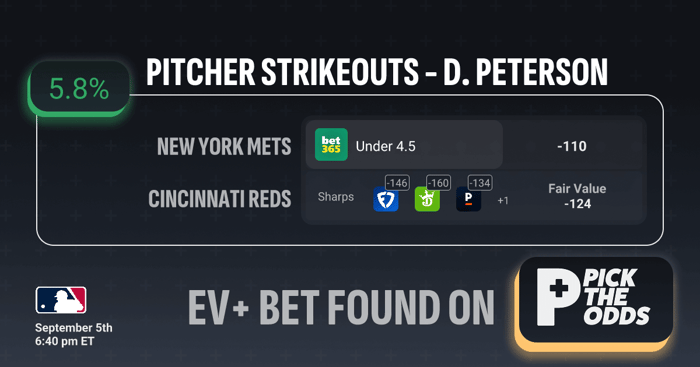

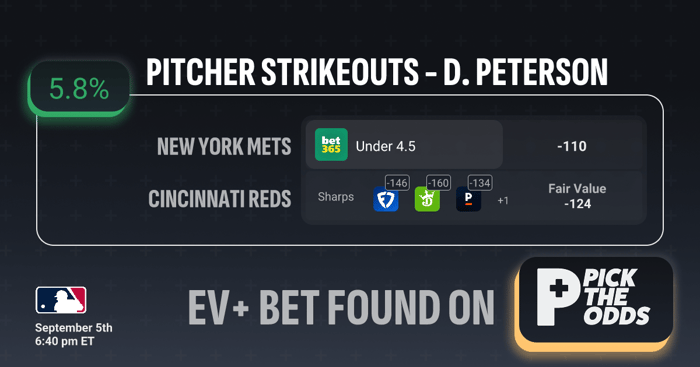

+EV Betting Example

Player: D. Peterson (pitcher)

Bet: Under 4.5 strikeouts

Odds: -110

Fair Value: -124

EV (expected value): 5.8%

Step 1: Understanding Fair Value

The fair value of -124 indicates what the odds should be based on the probability of the outcome. In other words, if the market were perfectly efficient, you’d need to risk $124 to win $100 on this bet.Market odds being offered: -110 (you risk $110 to win $100)

Fair odds based on probability: -124 (you should risk $124 to win $100)

Since the offered odds (-110) are better than the fair odds (-124), the bet is undervalued by the market.

Step 2: How +EV Is Calculated

The formula for expected value (EV) for a bet is:

EV= (Probability×Payout)−(1−Probability)×RiskMarket-implied probability for -110: = 52.4% probability.

True probability based on fair value (-124): = 55.3% probability.

Step 3: Positive Expected Value

Since the true probability (55.3%) > market probability (52.4%), this bet gives you a 5.8% edge. In other words, for every $100 wagered, you’d expect to make about $5.80 in the long run.

Step 4: Summary

Why +EV: The odds offered (-110) are better than the odds implied by the fair value (-124). You are essentially getting more payout for the same risk than the probability suggests. Over time, taking these bets leads to profit, which is the essence of +EV betting.

Identifying +EV Bets in Practice

Finding +EV opportunities is tough without the right resources. That’s why sharp bettors use tools like PickTheOdds to do the heavy lifting:

1) Line Shopping Made Easy

Instead of checking multiple sportsbooks manually, PickTheOdds compares markets instantly to show you where the best value lies.

2) Built-in EV Calculations

PickTheOdds highlights +EV bets automatically, so you don’t have to run the math every time.

3) Multiple Markets & Props

From MLB total, NFL spreads to CFB player props, Pick The Odds scans hundreds of markets to uncover value plays sportsbooks overlook.

Benefits

Long-term profitability

Objective, math-based decision making

Works across sports and markets

Compounding bankroll growth

Extra Benefit with PickTheOdds → Saves time by scanning thousands of odds to find hidden +EV bets in seconds.

Mistakes to Avoid

Overestimating true probability

Poor bankroll management

Ignoring line shopping (solved with PickTheOdds)

Chasing every small edge without a plan

Bankroll Management Strategies

Flat Betting: Risk the same % each play.

Kelly Criterion: Adjust bet size to match edge size.

Stay Disciplined: Even +EV bets can lose short-term.

EV Betting vs. Arbitrage & Value Betting

Arbitrage Betting: Risk-free but rare; PickTheOdds finds them automatically.

Value Betting: Similar to Expected value betting, focuses on mispriced odds.

EV Betting: The foundation—mathematical probability that applies to every bet type.

Final Thoughts

Sportsbooks make billions off emotional bettors. EV betting flips the odds by using math, discipline, and data. By applying these strategies and leveraging tools like PickTheOdds, you can consistently identify profitable plays and grow your bankroll like a pro.

Remember: This doesn’t guarantee wins every time—it guarantees profits over time. The key is consistency, bankroll discipline, and using the best tools available.

FAQ Section

1) What does EV mean in betting?

EV stands for expected value, the long-term profitability of a bet.

2) What is a +EV bet?

A bet where the probability of winning is greater than what the odds imply, giving you an edge.

3) How can I find +EV bets?

Use line shopping, models, and EV calculators. Tools like PickTheOdds highlight +EV plays automatically.

4) Is EV betting profitable?

Yes, if you apply it consistently stick to it long term and manage your bankroll.

5) What is CLV and why is it important?

CLV stands for Closing Line Value, which measures whether you placed your bet at better odds than the final line offered before the event started. If your wager consistently beats the closing line, it means you’re finding value and likely to be profitable long term. Sportsbooks set the closing line as the most efficient price, so tracking CLV is one of the best ways to evaluate if your betting strategy has a real edge.